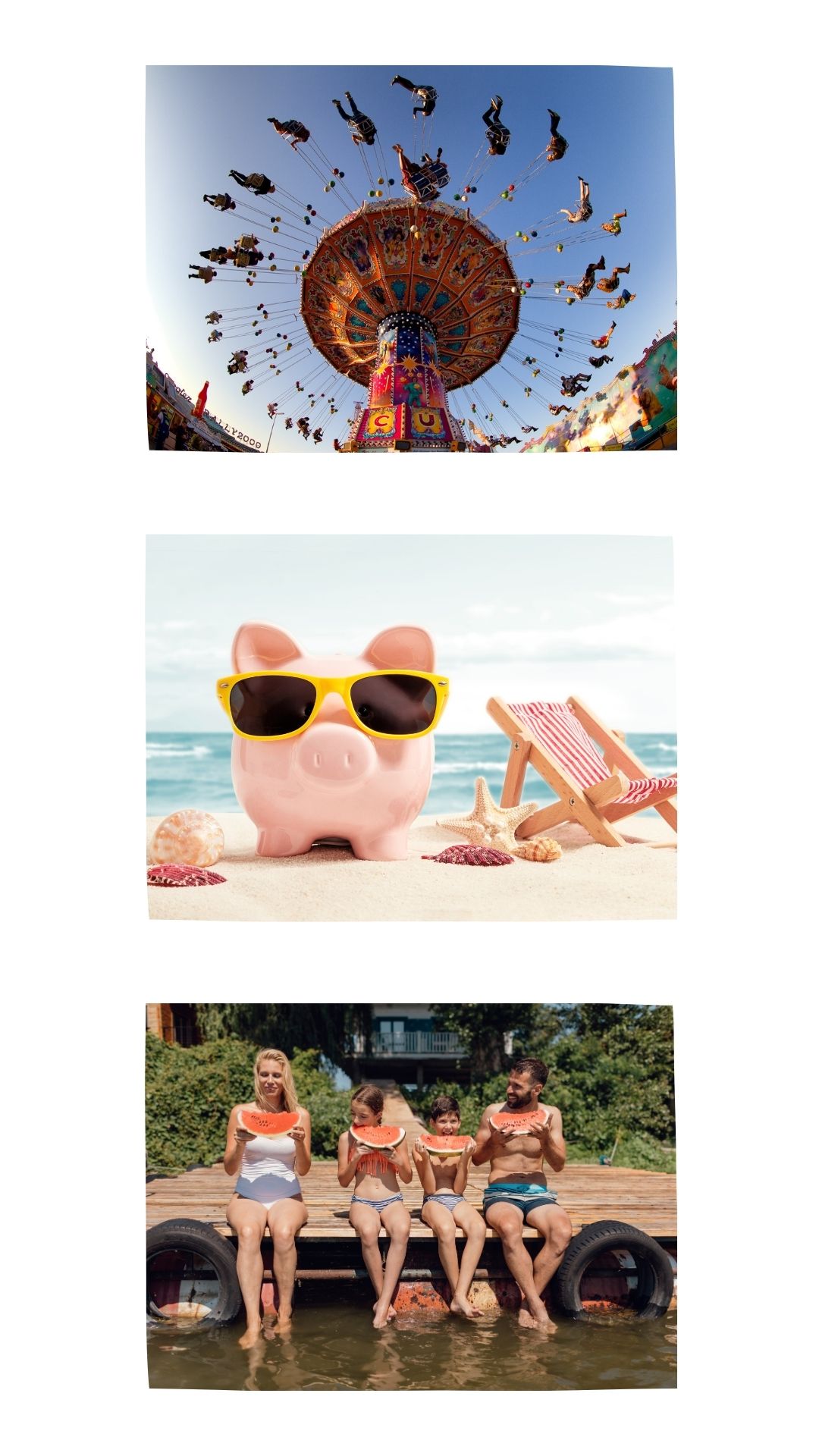

Talking to Your Kids About Summer Spending

Summer is a time we all look forward to—long days, family fun, and a break from the usual routine. But let’s be honest: summer can also stretch the family budget. From vacations and camps to spontaneous outings and higher utility bills, expenses add up quickly. That’s why having open conversations with your kids, especially teenagers, is key to teaching financial awareness and setting shared expectations.

Start with a Family Conversation

Begin the season with a simple, age-appropriate chat. Let your kids know that while summer is full of fun opportunities, those activities often come with added costs. This can help them better understand the “why” behind decisions and trade-offs.

“We’ve budgeted $1,200 for summer fun this year,” you might say. “That includes our beach trip, a couple of movie nights, and some extra treats. If we want to do more, we’ll need to look at ways to save or adjust.”

Use Real Numbers

Teens especially benefit from seeing real-life examples. Whether it’s how much a weekend getaway costs or what a daily coffee habit adds up to, numbers make it easier to grasp the impact of spending.

Try saying: “The waterpark costs $40 per person. For our family, that’s $160 in one day—about the same as a week’s worth of groceries.”

Involve Teenagers in the Planning

Teenagers can play an active role in helping the family stick to the summer budget. Give them a chance to help plan an outing within a set dollar amount or manage a portion of vacation spending, like snacks or souvenirs.

Better yet, talk about how they can pitch in. If they earn money from a summer job or allowance, discuss saving a portion toward a special experience.

“If you save $10 a week from your job, you could have $80 by August—that might cover that theme park ticket or your own vacation spending money.”

Make It a Learning Moment

Teaching kids about summer expenses isn’t about limiting the fun—it’s about building lifelong money habits. When they understand how budgeting works and see how their efforts can contribute to family plans, they’ll feel more empowered and included.

So, whether it’s choosing between two activities or finding creative ways to save, involving your kids in summer spending decisions can turn financial talks into real-world learning—and a more meaningful summer for everyone.